Description

📈Automatic Recovery & Smart Trade Management for MT4

WallStreet Recovery PRO MT4 is an advanced Expert Advisor for MetaTrader 4 designed to rescue, stabilize and grow trading accounts through intelligent recovery logic, position management and automated risk controls. Built for traders who need a professional “second-chance” engine, WallStreet Recovery PRO combines trade-rescue algorithms, adaptive scaling, and dynamic exit logic to recover losing trades, preserve capital, and turn tough market runs into controlled outcomes.

Whether you want to add a defensive layer to your manual trading, run it as a stand-alone recovery bot, or use it to protect prop-firm challenge accounts, WallStreet Recovery PRO MT4 focuses on responsible recovery rather than reckless averaging.

🔍 What WallStreet Recovery PRO MT4 Does (Overview)

WallStreet Recovery PRO is not a gambler’s tool — it’s a structured recovery and management EA. When an open position goes into an unfavorable drawdown, the EA uses a set of validated recovery mechanisms (controlled scaling, hedging options if enabled, dynamic stop adjustments, and timed exit logic) to reduce overall loss, lock partial profits, and seek a more favorable average entry/exit. All actions are governed by strict risk thresholds and equity protection rules.

Primary goals:

-

Reduce maximum drawdown on losing streaks

-

Recover losing trades with controlled additions (if chosen)

-

Preserve capital via equity-based safety stops

-

Provide transparency with detailed logging and trade reports

⚙️ Key Features & Technology

🛠 Recovery Engine (Controlled Scaling)

-

Adds positions in a disciplined, pre-defined sequence only when recovery conditions are met.

-

Uses volatility and liquidity filters to avoid adding before adverse spikes have passed.

🔁 Adaptive Stop & Exit Logic

-

Dynamic stop-loss and take-profit adjustments based on market conditions and average entry price.

-

Timed exits and partial closes to lock profits when recovery succeeds.

🧠 Risk-First Money Management

-

Equity-based lot sizing (percent of account) to avoid account blowout.

-

Max exposure caps and daily loss limits to stop the EA when conditions degrade.

🔍 Market Filters & Safety Layers

-

Spread, slippage and news filters to prevent trading during unsafe windows.

-

Session filters (London / New York timing) and broker checks.

📊 Analytics & Reporting

-

Detailed logs of recovery actions, cumulative P/L, and per-trade decision reasons.

-

Risk & performance metrics for transparency.

🔒 Optional Hedging Module (Configurable)

-

If your broker supports hedging, the EA can use limited hedging strategies as a defensive tool (fully toggleable).

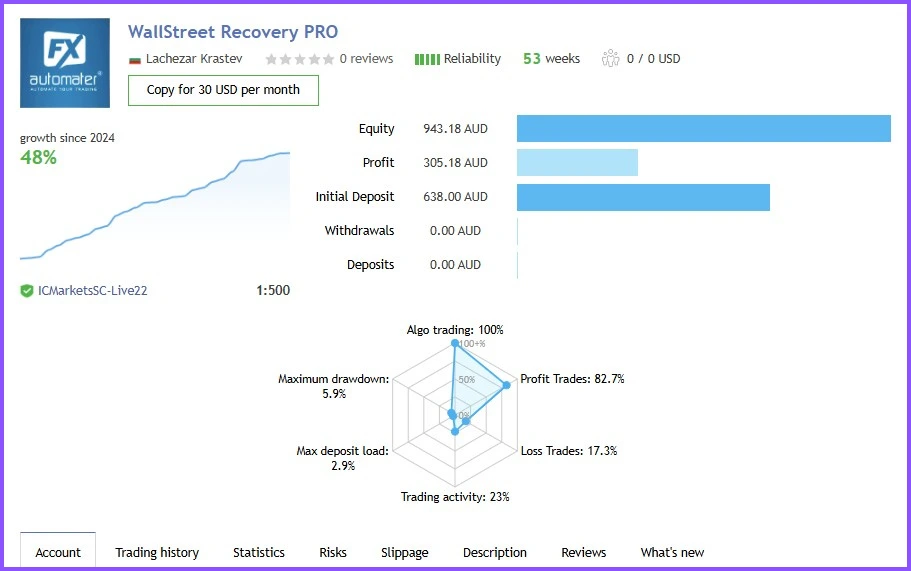

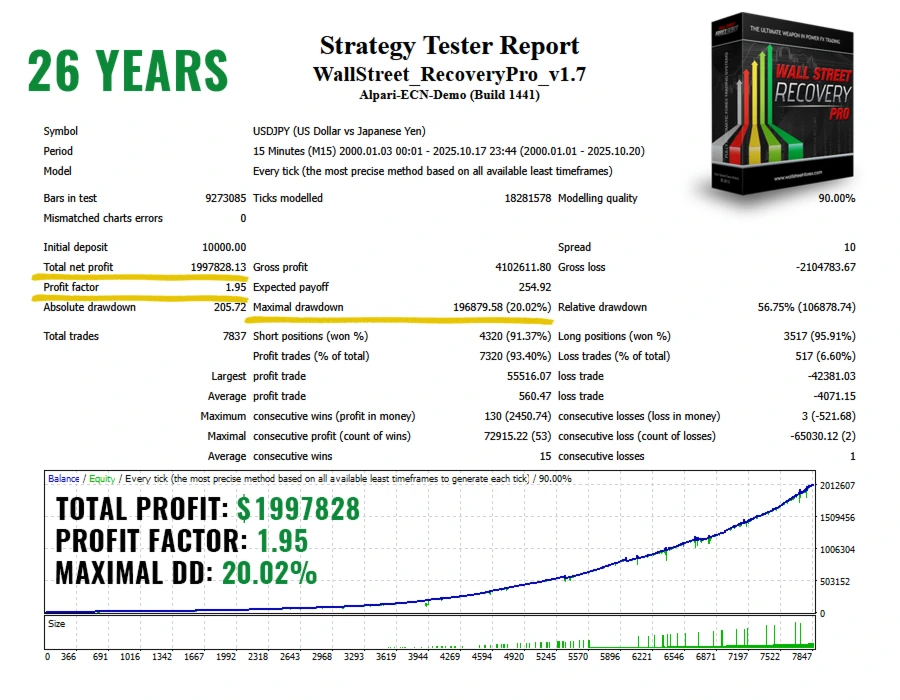

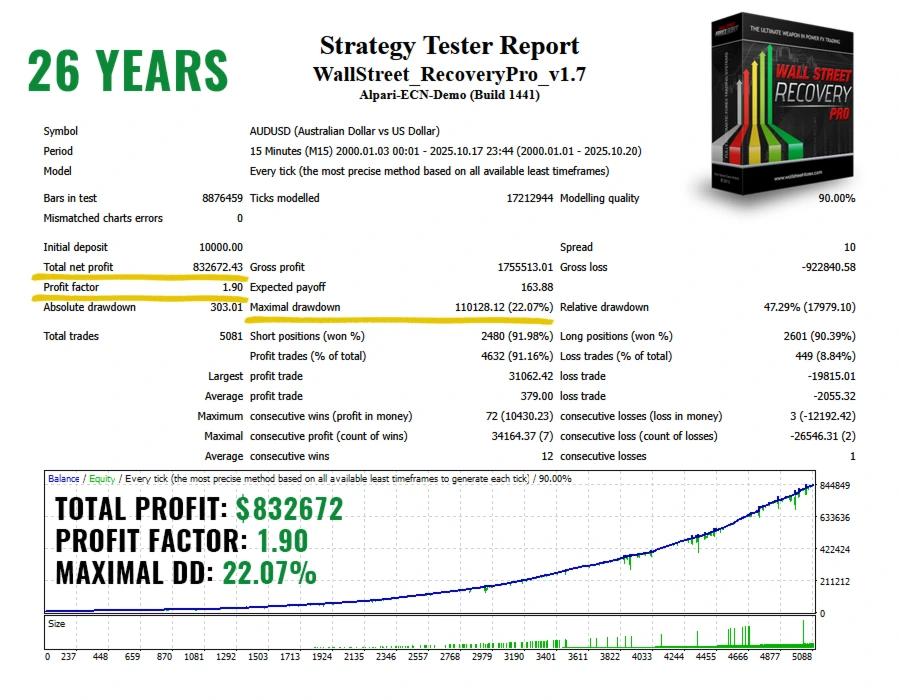

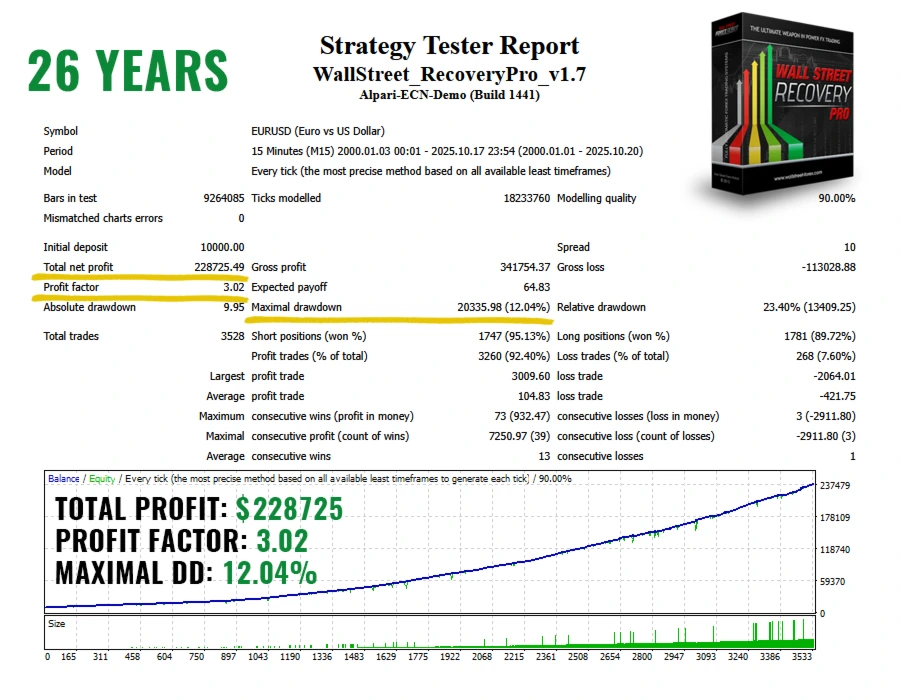

⭐ WallStreet Recovery PRO MT4 Reviews

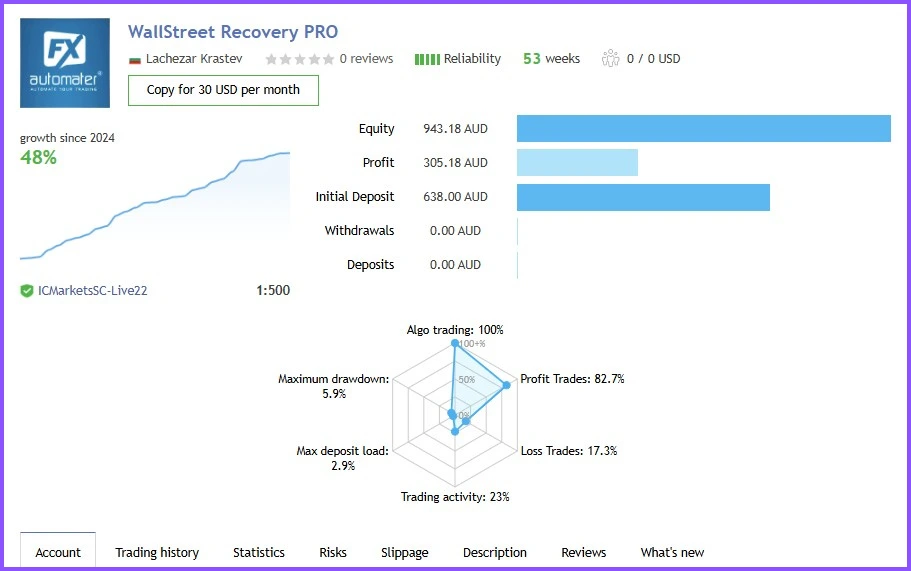

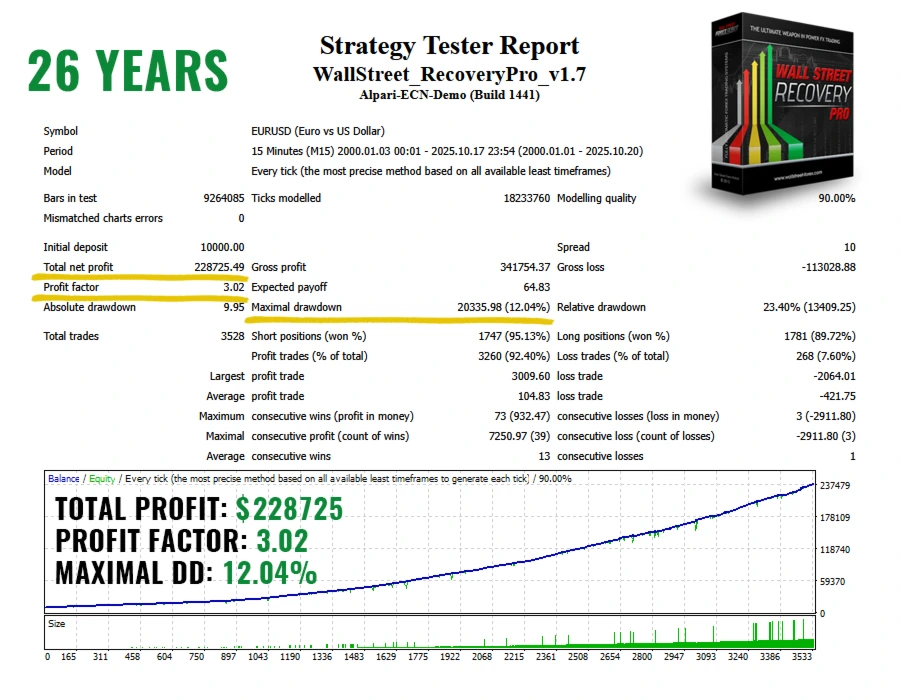

WallStreet Recovery PRO MT4 is known for its stable recovery strategy and disciplined risk management, making it a popular choice among traders who prioritize account safety. Below, you’ll find live signals, verified Myfxbook results, and backtest reports that showcase how the EA performs in real trading conditions and manages drawdowns effectively.

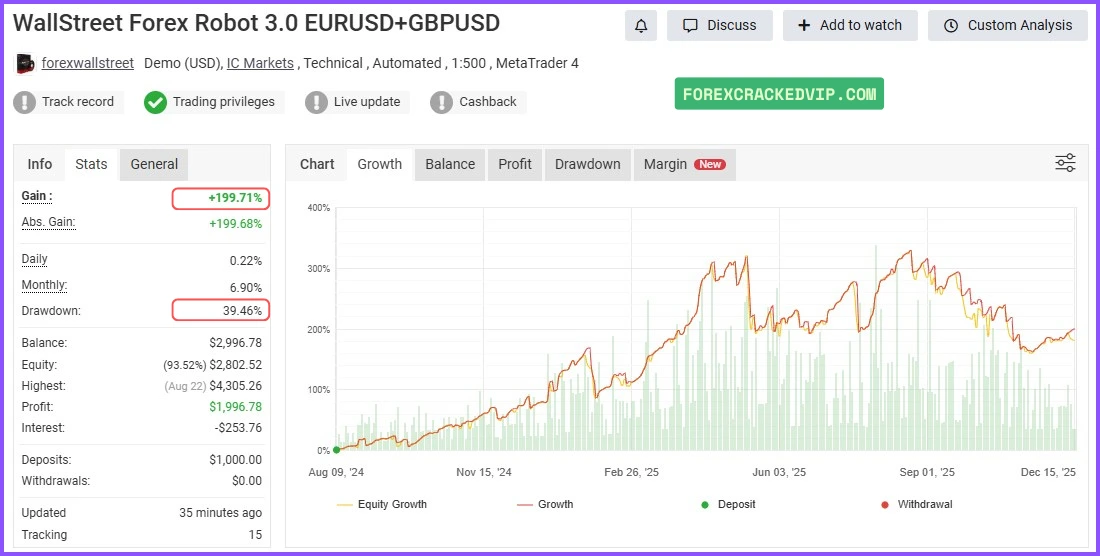

Myfxbook Results #1

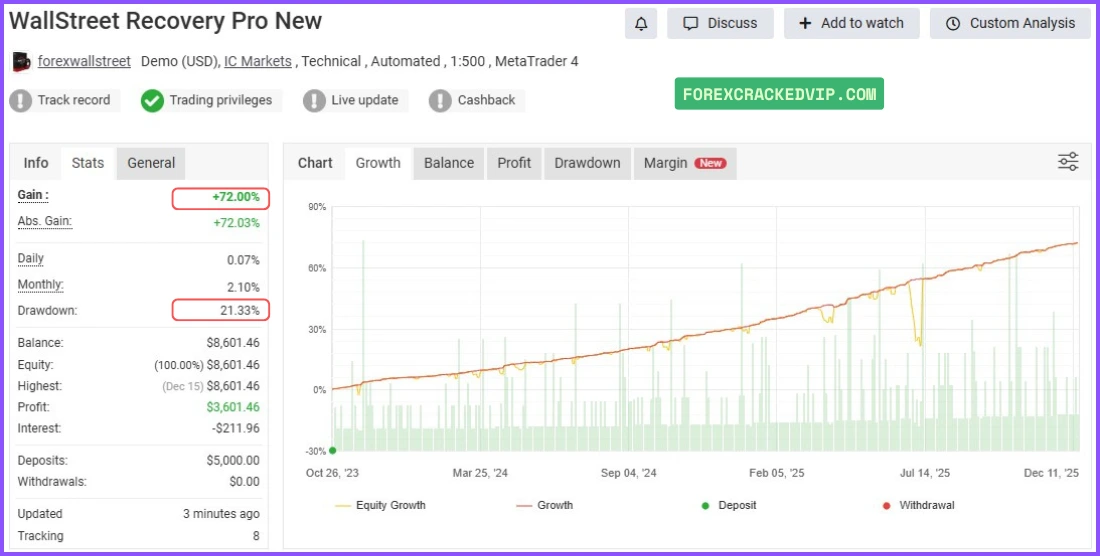

Myfxbook Results #2

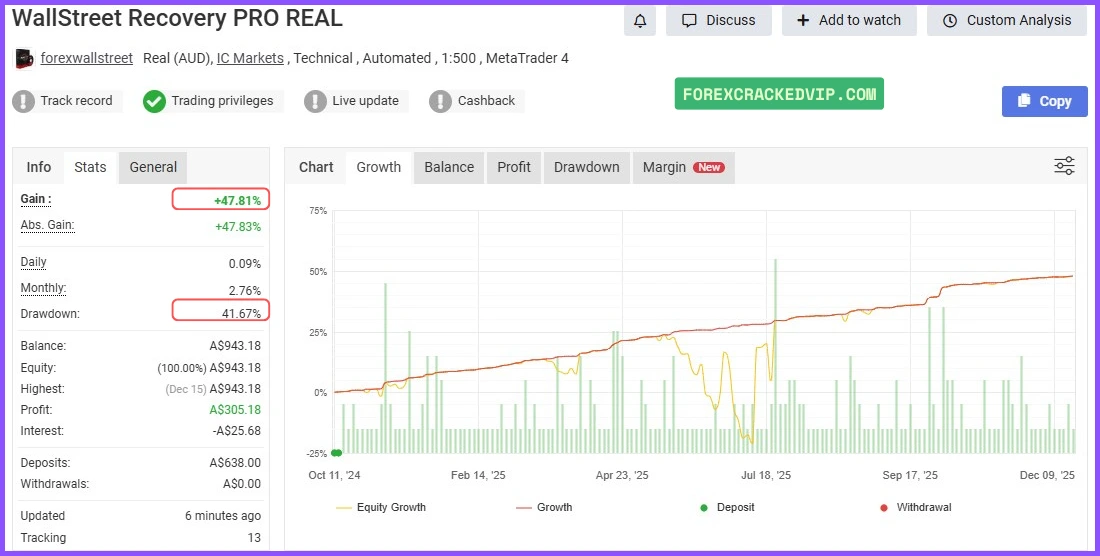

Myfxbook Results #3

Backtest Results

⭐ Specialities & Advantages

✅ Recovery Focused (Not Martingale) — Uses measured recovery techniques rather than reckless doubling.

✅ Equity Protection First — Stops trading when drawdown thresholds are reached.

✅ Configurable Aggression Levels — Conservative → Balanced → Aggressive presets for different trader risk profiles.

✅ Works With Manual Trades — Can manage and attempt recovery on manually opened positions (subject to settings).

✅ Transparent Behavior — Full logging and deterministic rules so you can audit every recovery decision.

✅ Prop-Challenge Friendly Mode — Settings to keep drawdown and daily loss within typical prop firm rules (test before use).

📊 WallStreet Recovery PRO MT4 vs Other Recovery Tools

| Capability | WallStreet Recovery PRO MT4 | Typical Recovery EA | Martingale/Blind Averager |

|---|---|---|---|

| Recovery Logic | ✅ Controlled & rules-based | ⚠️ Varies | ❌ Often reckless |

| Equity Protection | ✅ Strong (stop limits) | ⚠ Moderate | ❌ Weak |

| Hedging Option | ✅ Optional & configurable | ⚠ Limited | ❌ Rare |

| Manual Trade Support | ✅ Yes | ⚠ Some | ❌ No |

| Logging & Transparency | ✅ Full logs & reports | ⚠ Limited | ❌ Minimal |

| Prop-Firm Mode | ✅ Yes (presets) | ⚠ Some | ❌ No |

| Safety vs Aggression | ✅ Balanced | ⚠ Varies | ❌ Aggressive |

Conclusion: WallStreet Recovery PRO MT4 is built for traders who want smart, auditable, and safe recovery — not gambling strategies that risk account survivability.

⚙️ Recommended Settings & Broker Requirements

-

Platform: MetaTrader 4 (latest build)

-

Account Type: ECN / Raw Spread recommended (but works on standard)

-

Pairs: Major FX & XAUUSD (check presets per pair)

-

Leverage: 1:100 – 1:500 (use responsibly)

-

Minimum Balance: $200+ (conservative usage); recommended $500+ for production use

-

VPS: Recommended for 24/5 uptime and reliable execution

-

Presets: Start with Conservative on demo → Balanced → Aggressive after live verification

✅ How It Works — Short Workflow

-

EA monitors open trades for defined recovery triggers (drawdown %, time, market condition).

-

When trigger conditions are met, EA evaluates liquidity & spread filters.

-

EA applies recovery action: controlled add, hedging, or dynamic stop-adjust.

-

EA monitors progress; partial close or full exit performed when recovery target reached or exit conditions met.

-

EA halts when equity or daily loss limits are reached (safety stop).

🌟 Become a VIP Member at MT4Systems

Unlock exclusive benefits and premium forex tools by joining our VIP membership! Whether you’re a beginner or a pro trader, VIP access gives you a serious edge in the market.

🎯 One time payment

✨ Unlimited Lifetime Access

🔓 Full EA File Access with Presets

💬 Premium Support via Telegram

🎁 Plus: Access to 50+ Premium EAs & Indicators

📢 Join Our Telegram Channel: @officialmt4systems

❓ Frequently Asked Questions (FAQ)

Q1 — Can WallStreet Recovery PRO MT4 manage my manually placed trades?

Yes — the EA supports recovery management for manual trades if you enable the option and assign magic numbers or allow the EA to detect manual orders. Always test on demo first.

Q2 — Does this EA use martingale or grid?

No. The EA uses controlled recovery techniques with equity protection. It is not a blind martingale or grid tool.

Q3 — What happens if the recovery fails?

If recovery does not reach the defined targets, the EA follows strict exit rules and will stop trading when equity/daily loss thresholds are hit to prevent further damage.

Q4 — Is hedging mandatory?

No. Hedging is optional and fully configurable. Use only if your broker supports hedging and you understand the risks.

Q5 — Is it suitable for prop firm challenges?

There is a Prop Mode preset designed to help keep daily and total drawdown within common prop-firm rules — however you must test and ensure settings align with the vendor’s recommended rules and the firm’s conditions.

Q6 — How should I test the EA?

Run Conservative preset on a demo account for 2–4 weeks with a broker matching your planned live conditions. Review logs and performance before switching to live.

🧾 Final Verdict — WallStreet Recovery PRO MT4

WallStreet Recovery PRO MT4 is a thoughtfully engineered recovery and trade management EA that prioritizes capital protection, transparency and measured recovery techniques over dangerous “get rich quick” tactics. It is best used by traders who want a responsible recovery layer on their accounts or a sophisticated tool to help maintain prop-firm rules during drawdowns. With clear logging, safety stops and configurable aggression levels, it provides a robust, auditable approach to handling losing trades.

Reviews

There are no reviews yet.