Description

🤖Ultra-Low-Latency AI Trading for Professional Traders

AI X HFT EA MT4 is a next-generation Expert Advisor that combines artificial intelligence decisioning with high-frequency trading (HFT) style execution on MetaTrader 4. Engineered for traders who demand millisecond decisioning, advanced risk controls, and professional order routing, AI X HFT is designed to capture micro-opportunities across major FX pairs and metals while keeping drawdown under strict control.

This EA is ideal for algorithmic traders, prop-firm applicants, VPS users, and anyone who needs speed + intelligence in one robust MT4 package.

🚀 What Makes AI X HFT EA MT4 Special? (Core Promise)

🤖 AI Decision Engine — Machine-learned models analyze multi-factor signals (price action, volatility, microstructure) to pick high-probability micro-moves.

⚡ HFT Execution Layer — Optimized order sending logic to minimize slippage and requotes on fast brokers.

🔁 Adaptive Risk Management — Real-time lot scaling, volatility-based SL/TP, and equity protection.

🧰 Plug & Play + Advanced Tuning — Ready presets for beginners and deep tweak options for quant users.

🖥 VPS & Low-Latency Ready — Architected to run on colocated VPS for maximal performance.

Keywords: AI Forex Robot MT4, HFT EA MT4, low latency forex EA, high frequency trading EA, automated forex robot.

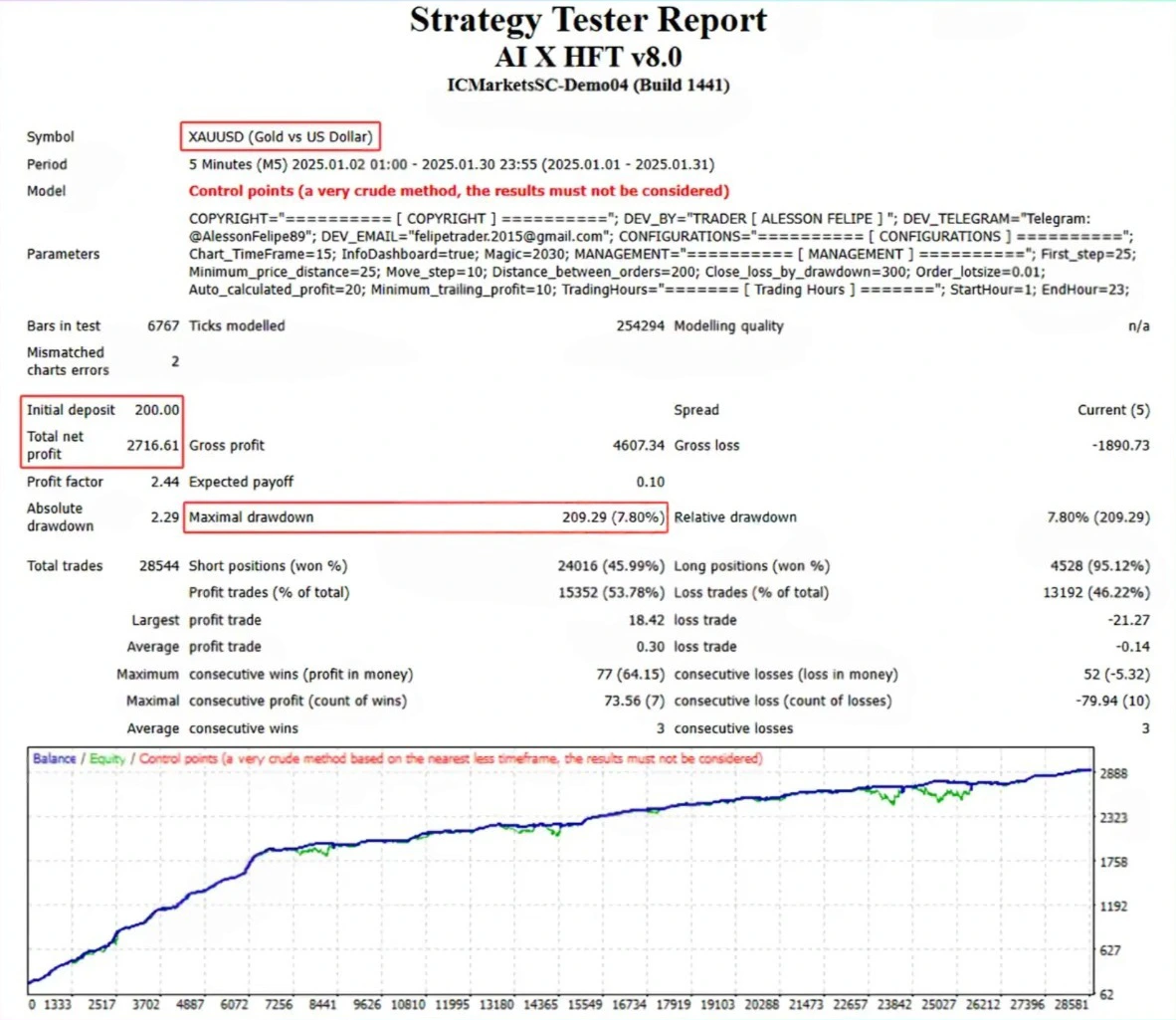

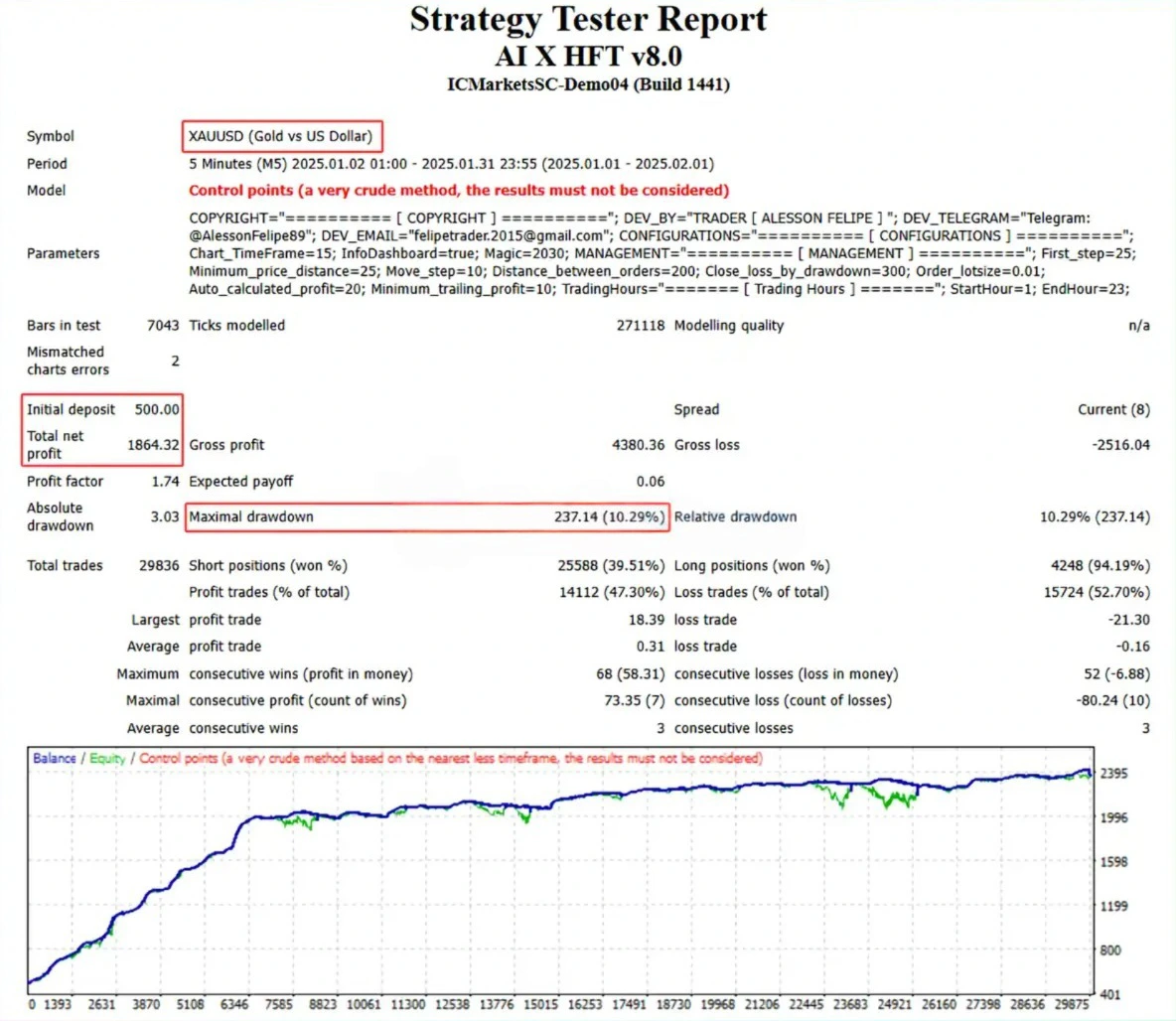

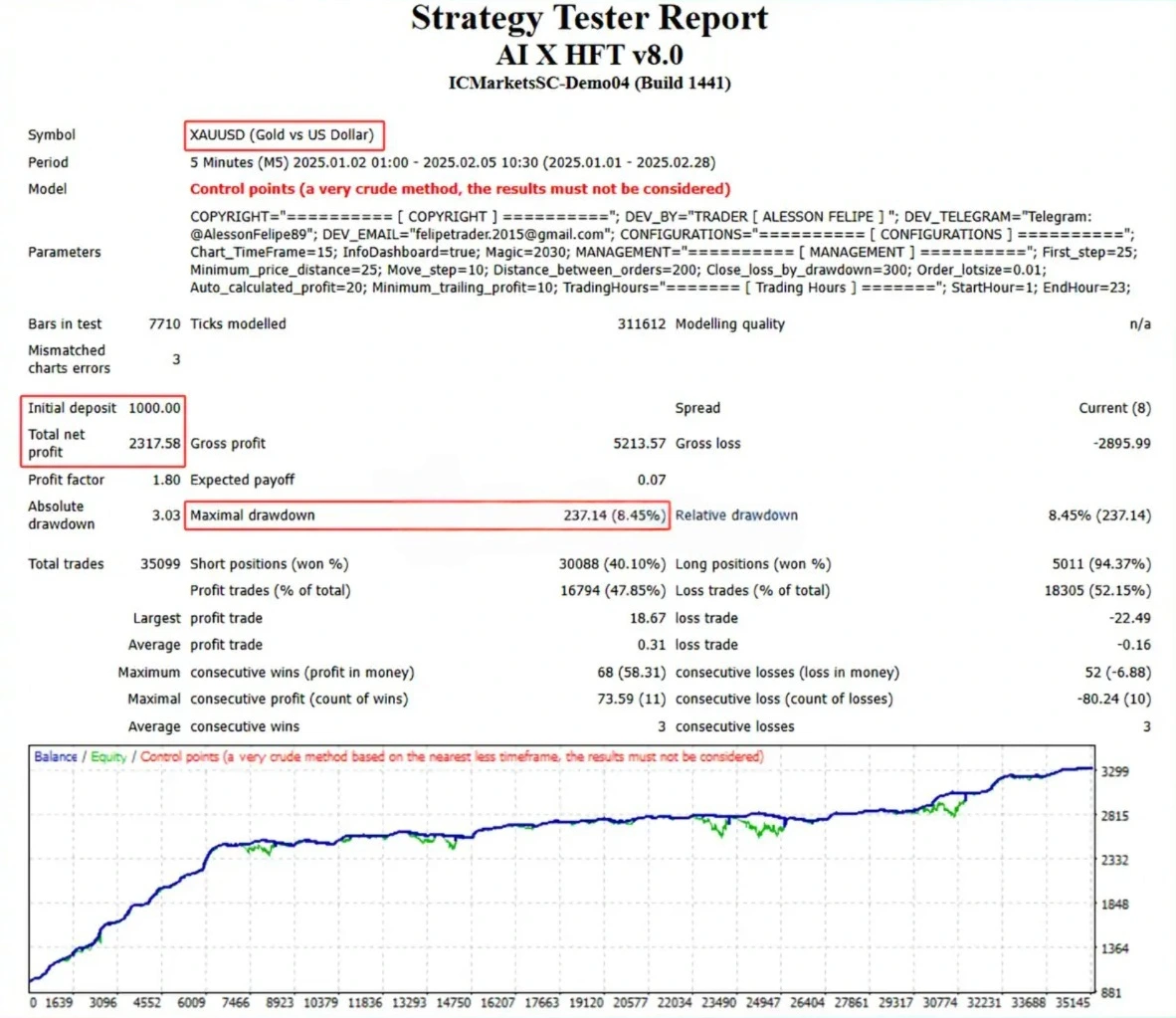

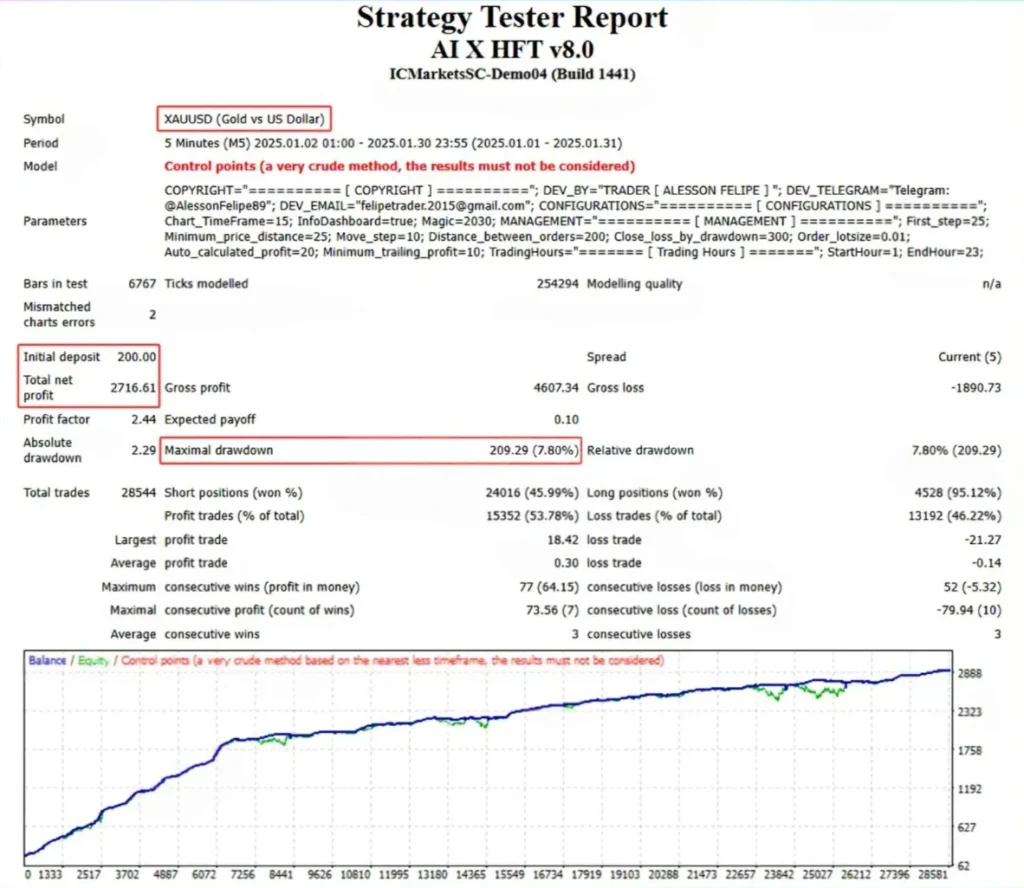

📊AI X HFT EA MT4 Backtest Results

✅ Initial Deposit: $200

✅ Total Net Profit: $2,716.61

✅ Maximum Drawdown: 7.80%

✅ Initial Deposit: $500

✅ Total Net Profit: $1,864.32

✅ Maximum Drawdown: 10.29%

✅ Initial Deposit: $1,000

✅ Total Net Profit: $2,317.58

✅ Maximum Drawdown: 8.45%

🔍 Deep Feature Breakdown

1. AI-Powered Signal Engine 🧠

-

Ensemble models (pattern detectors + statistical filters) produce signal confidence scores.

-

Multi-timeframe analysis (tick, M1, M5) for micro-trend confirmation.

-

Online adaptation: models reweight short-term features if market regime shifts.

2. HFT-Style Execution ⚡

-

Smart order routing: conditional limit orders, FastCancel logic, and spread-aware sending.

-

Execution priority paths to reduce slippage during volatile spikes.

-

Latency-sensitive throttling to prevent bad fills during news.

3. Dynamic Money & Risk Management 🔐

-

Volatility-adjusted lot sizing (ATR / tick-vol metrics).

-

Equity stop & daily loss limiter.

-

Auto-reduce mode when execution quality degrades (high spread, slippage).

4. Market Filters & Safety Layers 🛡️

-

Session filters (avoid low-liquidity hours)

-

News and spread filters

-

Max open trades limit and per-pair exposure caps

5. Monitoring & Telemetry 📊

-

Detailed log output for every micro-decision (entry confidence, latency, fill quality).

-

Optional email/SMS/VPS alerts for critical events.

⚙️ Recommended Setup & Broker Requirements

To use AI X HFT EA MT4 as intended, follow these recommendations:

-

Platform: MetaTrader 4 (build that supports fast execution)

-

Broker: ECN / Raw Spread / Low latency (priority)

-

Minimum Balance: $500 (conservative) — higher for aggressive modes

-

Leverage: 1:100 – 1:500 (be cautious with leverage)

-

Timeframes: Tick / M1 / M5 (EA uses micro-timeframes internally)

-

Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD (optimized pairs shipped)

-

VPS: Colocated or low-latency VPS (essential for HFT performance)

-

Network: <30ms latency to broker recommended

📈 Trading Strategy Overview (How It Acts)

-

Continuous micro-scan of orderbook proxies and tick behavior.

-

AI engine computes a confidence score for short intraday opportunities.

-

If confidence > threshold and market filters pass, EA sends a low-latency order (limit/take-profit/stop).

-

Trade is managed dynamically: partial profit taking, quick trailing, or immediate close on adverse latency conditions.

-

System adapts its thresholds if execution quality or volatility profile changes.

Important: This EA is not a “set and forget” miracle box — proper infrastructure (VPS, broker) matters for results.

✅ Advantages & Unique Selling Points

🔥 Speed + Brains: Combines AI accuracy with HFT speed — rare among retail MT4 EAs.

🧾 Transparent Telemetry: Detailed logs let you review decision and execution quality.

🔁 Adaptive to Market Regimes: AI reweights signals when volatility shifts.

🛡 Strong Capital Protection: Equity caps, daily loss limits, and spread fallbacks.

🧰 Two Modes: Conservative (low risk / prop-friendly) and Performance (higher throughput).

🧑💻 Developer Support & Presets — recommended presets for different brokers and account sizes.

🆚 Comparison — AI X HFT EA MT4 vs Other Tools

| Feature / Metric | AI X HFT EA MT4 | Standard Scalper EA | Grid / Martingale EA | Retail HFT-like EA |

|---|---|---|---|---|

| AI Decisioning | ✅ Ensemble models | ❌ Rule based | ❌ Rule based | ⚠ Limited |

| Execution Latency Focus | ✅ HFT optimized | ⚠ Moderate | ❌ No | ⚠ Some focus |

| Risk Controls | ✅ Advanced | ✅ Basic | ❌ Weak | ✅ Varies |

| Drawdown Profile | Low–Moderate | Moderate | High | Varies |

| Broker Sensitivity | High (requires ECN) | Medium | Low | High |

| Telemetry & Logs | ✅ Full | ⚠ Minimal | ❌ None | ⚠ Limited |

| Prop-Firm Suitability | ✅ Conservative mode | ⚠ Sometimes | ❌ No | ⚠ Unclear |

Takeaway: AI X HFT EA MT4 targets traders who can provide professional infrastructure and want an edge from algorithmic speed and AI — it’s not a casual “set-and-forget” retail EA.

🌟 Become a VIP Member at MT4Systems

Unlock exclusive benefits and premium forex tools by joining our VIP membership! Whether you’re a beginner or a pro trader, VIP access gives you a serious edge in the market.

🎯 One time payment

✨ Unlimited Lifetime Access

🔓 Full EA File Access with Presets

💬 Premium Support via Telegram

🎁 Plus: Access to 50+ Premium EAs & Indicators

📢 Join Our Telegram Channel: @officialmt4systems

❓ Frequently Asked Questions (FAQ)

Q1 — What is HFT EA and how is it different from normal EAs?

Answer: HFT (high-frequency trading) style EAs emphasize execution speed, order route optimization, and micro-opportunity capture. AI X HFT adds machine-learned signal validation to reduce false entries — so it’s speed + intelligence, not just speed.

Q2 — Do I need a special broker?

Answer: Yes — use a low-latency ECN or raw-spread broker. The EA’s performance depends on low spreads and fast order fills.

Q3 — Is a VPS required?

Answer: Highly recommended. For true HFT behavior you should run the EA on a low-latency VPS (ideally colocated near broker servers).

Q4 — Can I use this EA in prop-firm challenges?

Answer: There is a Conservative/Prop mode that limits daily drawdown and trade aggressiveness — but always verify with the prop firm rules and test extensively.

Q5 — Does the EA use martingale, grid, or other risky techniques?

Answer: No. The default strategy uses fixed/volatility-adjusted sizing with equity caps — no martingale or grid.

Q6 — What pairs and timeframes are best?

Answer: Best pairs: EURUSD, GBPUSD, USDJPY, XAUUSD. Timeframes: micro (ticks/M1) for AI signals, but EA manages intra-minute executions automatically.

Q7 — How much capital do I need to start?

Answer: Minimum suggested is $500 for conservative mode; $2,000+ for performance mode. Use lot sizing guidance in presets.

Q8 — How do I monitor performance?

Answer: The EA provides detailed logs that you can review for execution latency, fill quality, and signal confidence scores. We also provide configuration to send alerts (email/Telegram).

✅ Best Practices & Setup Checklist

-

Choose an ECN / Raw Spread broker with <1.5 pip avg spread on EURUSD.

-

Deploy on low-latency VPS (<30ms RTT to broker).

-

Run demo for 2–4 weeks to verify execution/performance.

-

Start in Conservative preset, then scale to Balanced → Performance.

-

Monitor logs weekly and update presets if execution metrics change.

📣 Final Verdict — Who Should Use AI X HFT EA MT4?

AI X HFT EA MT4 is for serious algo traders who can invest in the required infrastructure (VPS + ECN broker) and want a modern combination of AI signal quality and HFT execution. If you’re aiming for incremental micro-edge gains and have the discipline to monitor execution quality, this EA provides a professional-grade solution not commonly found in typical retail bots.

Reviews

There are no reviews yet.